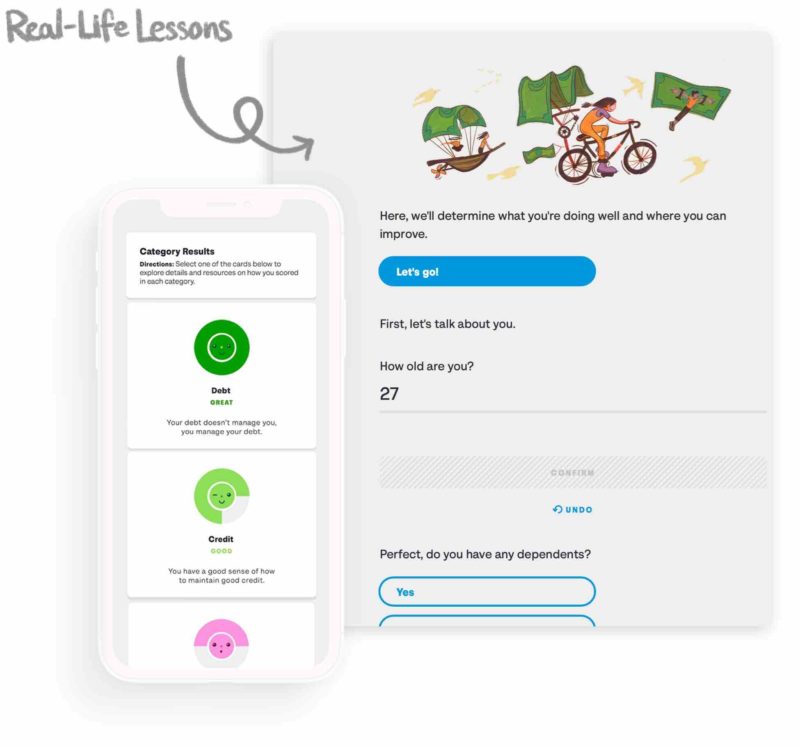

Helping you become your best financial self.

Explore by resource type or browse by topic by scrolling down below Looking for something specific? Plug it into the search bar, find the information you need, and start taking control of your finances right away. All of these resources are available on any device.

Borrowing & Credit

|

What is a HELOC?Seniors are aggressively targeted by scammers. Learn the red flags to watch out for and common scams that could be attempted on you or someone you love. |

Refinancing can help you get out of debt quicker or pay less in interest if everything lines up.

|

Retirement

Transitioning to RetirementWhen you’re mapping out the best route to collecting retirement income, there’ll be several forks in the road. But you can arm yourself with knowledge to make informed decisions. |

Understanding IRA'sIndividual retirement accounts (IRAs) can look intimidating and cryptic when you begin planning for retirement, but there are some foundational lessons to learn so you plan wisely. |

If you’re lucky enough to be introduced to a 401(k), you’ll make a friend for life. |

Budgeting

Income and ExpensesEveryone spends money, but many people don't know how to track how much they're spending or how to prioritize it. |

Learning to BudgetLearning to create a budget is the most important thing you can do for your financial health. |

With interest, the money you’re saving is always growing, but the same applies to the money you owe. |

Calculators

%20(1921%20%C3%97%201080%20px).png) Student Loan PayoffWhen you’re mapping out the best route to collecting retirement income, there’ll be several forks in the road. But you can arm yourself with knowledge to make informed decisions. |

Rule of 72The Rule of 72 predicts how long an investment will take to double based on a fixed annual interest rate. |

An emergency fund can be used to pay for essential expenses and propel you through a tough time. It should cover your take home pay for at least three months, but ideally six. This calculator shows you how much you need to save each month to reach your emergency fund savings goal. |